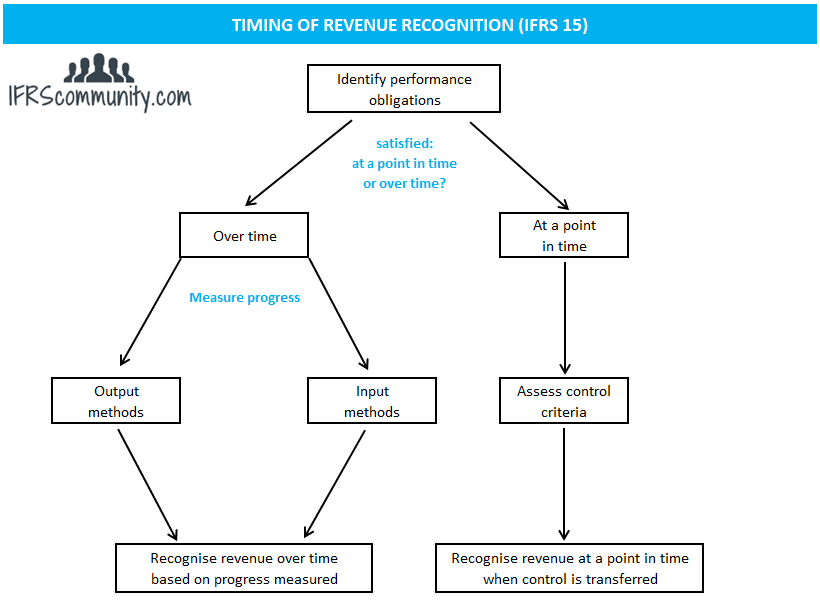

Identifying performance obligations is critical to revenue recognition under IFRS 15 - BDO Australia

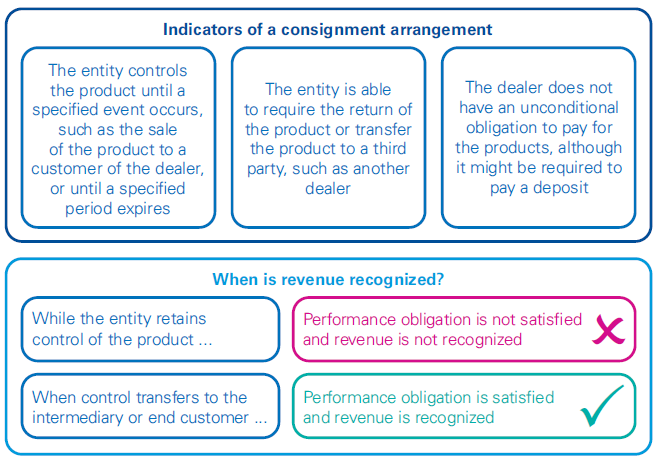

Everything You Wanted to Know about IFRS 15 but Were (Not) Afraid to Ask: Questions and Answers – dReport in English

Heads Up — What Private Companies Should Know About the New Revenue Recognition Standard (April 11, 2018) | DART – Deloitte Accounting Research Tool

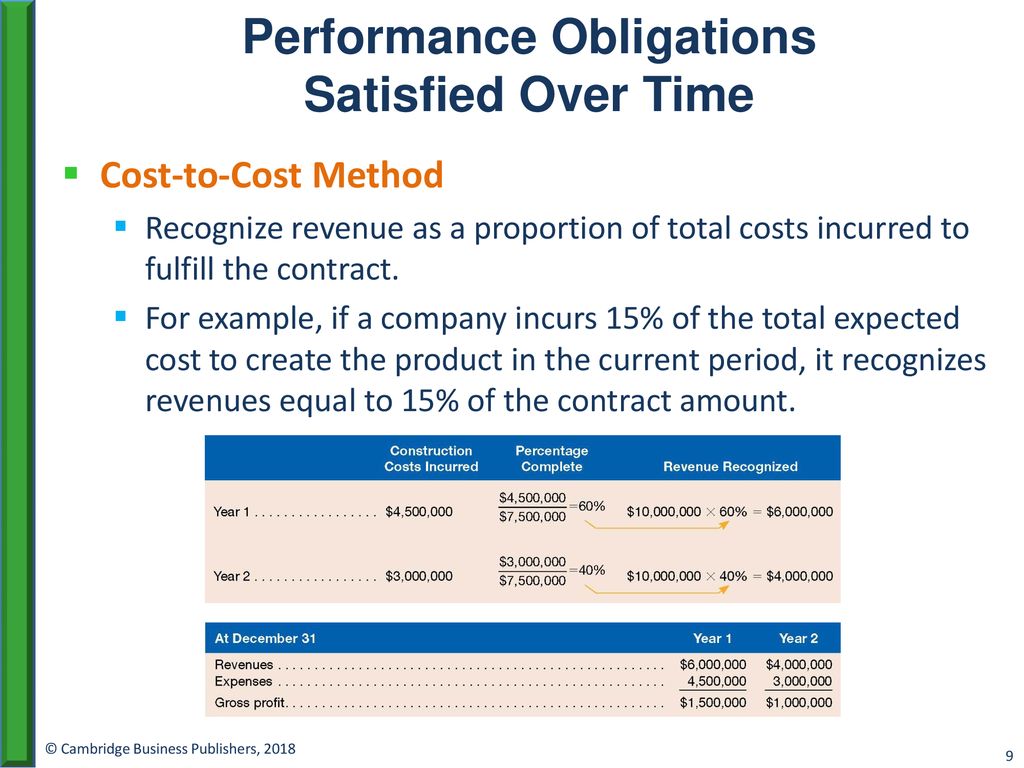

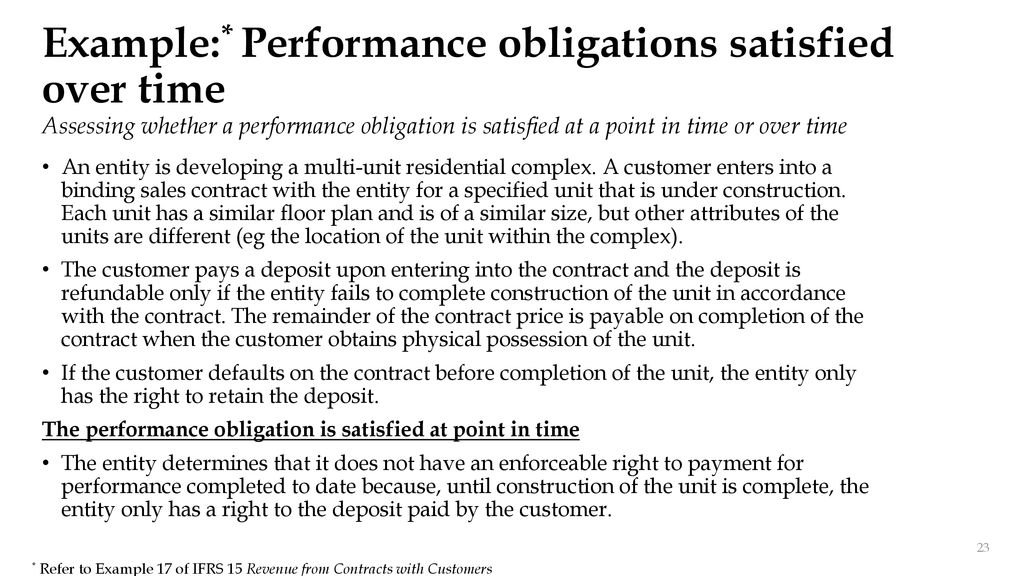

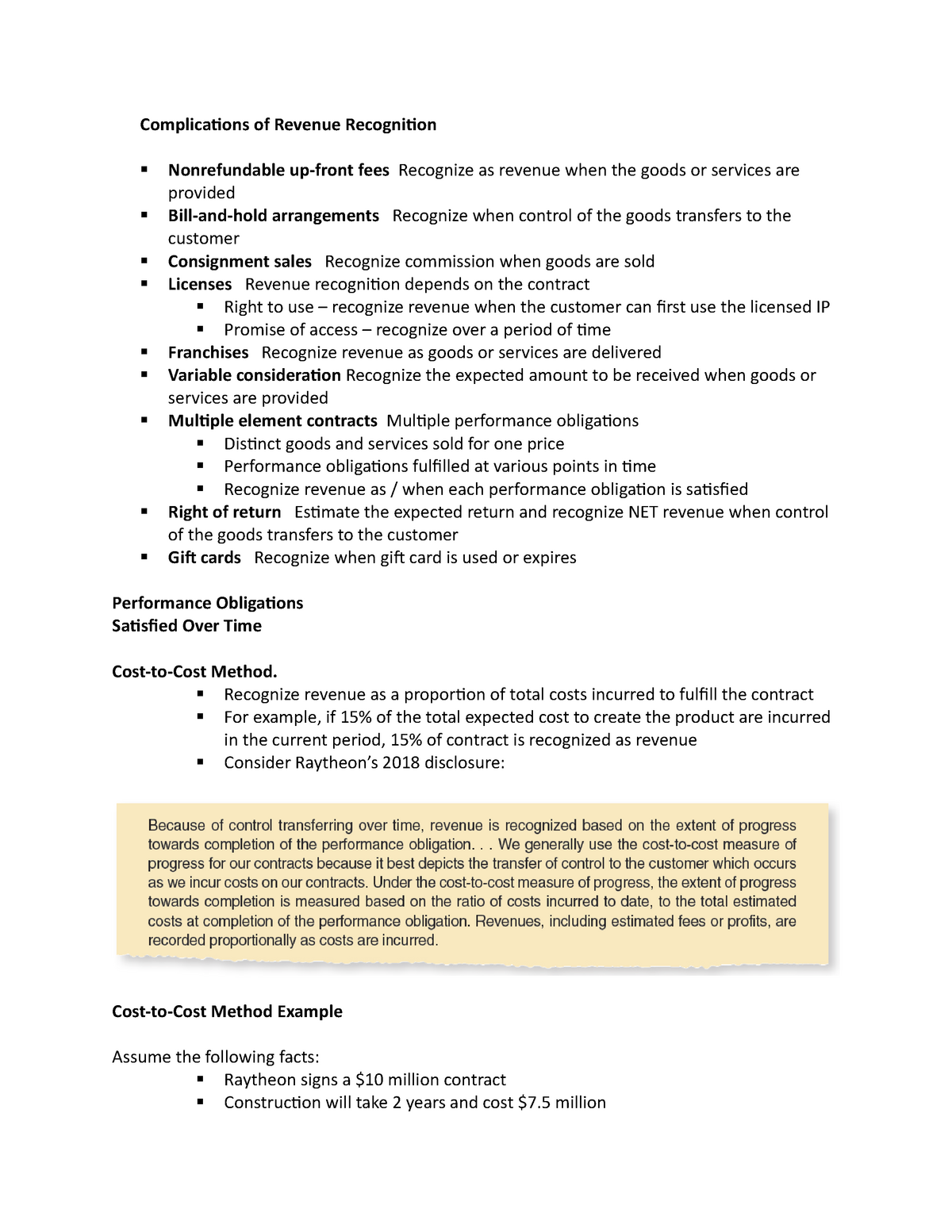

Complications of Revenue Recognition - § Recognize revenue as a proportion of total costs incurred - StuDocu

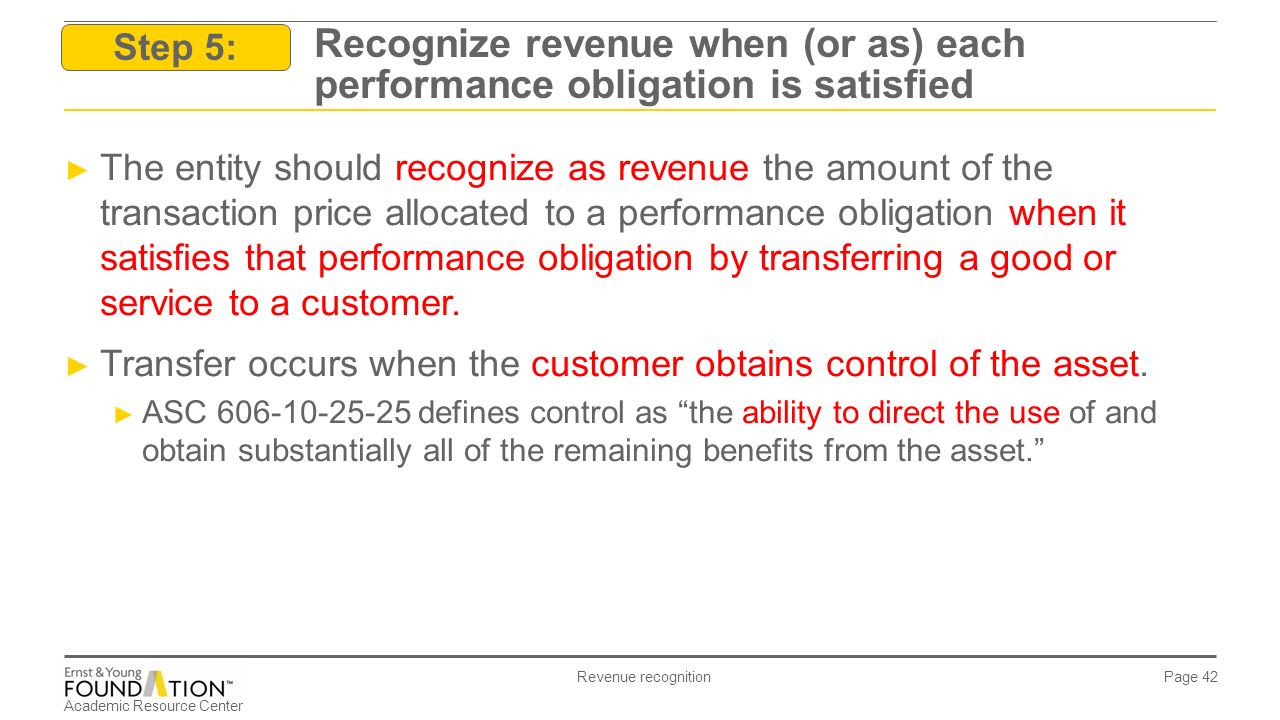

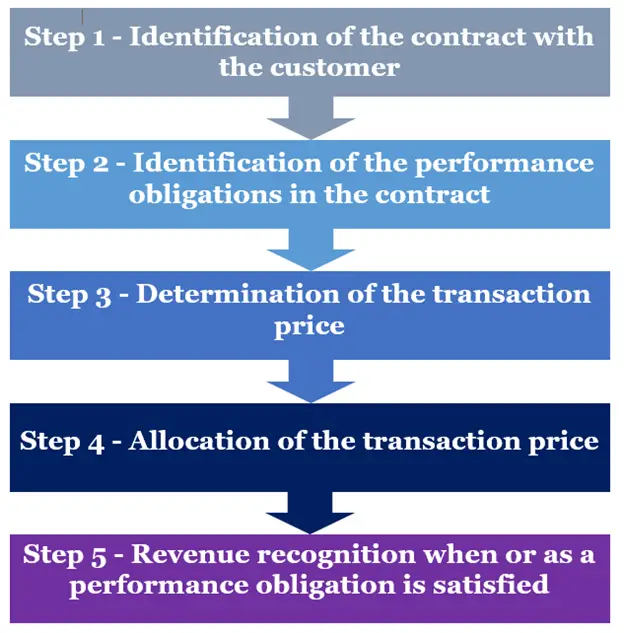

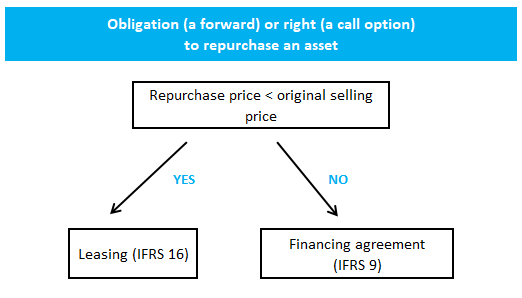

Step 5 Recognise The Revenue When The Entity Satisfies Each Performance Obligation – Annual Reporting